Incoming tour operators, DMCs and MICE companies get lots of invoices from suppliers. You package and book lots of services, so this means lots of supplier invoices to check.

Supplier invoices must go through these steps:

- Registration – Accounts is aware that an invoice has been received.

- Approval – checking if it’s correct. potential corrections.

- Payment process – registering the payment in accounting system.

Below we go through some of the methods to handle the registration, approval, corrections and payment of supplier invoices. But I will start with my preferred method.

My preferred supplier invoice flow

A slim integration – An accounts system that can talk to Nitro

- All invoices are received by Accounts.

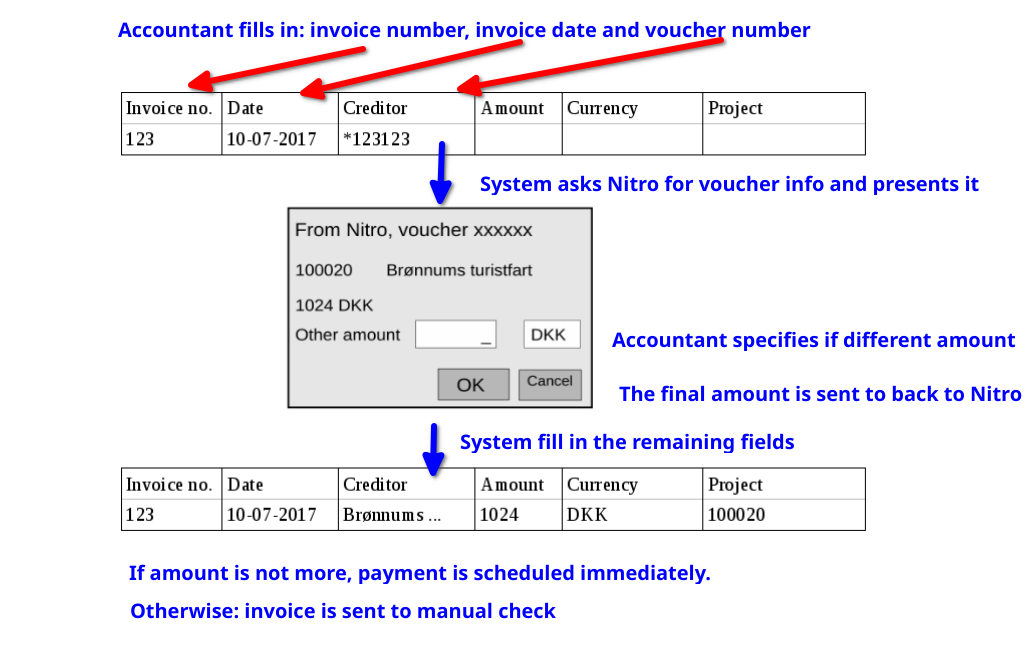

- When registering the accountant enters the invoice date and number in the accounts system. They search by a reference: e.g. voucher number.

- The accounting system prompts Nitro for info and sends back the registered amount.

See the figure below for a visualization of the invoice flow.

This way you make the common case fast.

Improvements:

- Having a digital invoice management system makes it easy to delegate approval of an invoice and to lookup a status if nothing has happened. Especially for multi-tour invoices where multiple people can approve different lines simultaneously.

- Automated scanning of the incoming invoices can further automate the flow, as long as it’s able to handle the many different types of invoices.

How Nitro can help

- Calculates the expected cost.

- Shows previously registered invoices.

- Creates invoice correction emails.

A list of various supplier invoice flows

- Manual check, late registration

Supplier invoices are sent directly to the person who booked the service for approval. It’s checked by the person and thereafter sent to accounts for registration/payment.

Upsides: simple and require no organization work.

Typical problems: slow approval process, staff overload in high season, double payments for service due to weak registration of invoices, tendency to approve without thorough check, no overview from accounting. - Central registration, Manual Check

Supplier invoices are sent to invoices@example.com, registered by accounts and from there sent to manual check with the person to booked. It’s a variation of the Manual check method and shares all downsides except the accounting overview. - Central registration, prepared purchase orders

When a tour is confirmed and bookings has been made, the booking person must fill in a spreadsheet with all the expected costs for the tour. When accounts receive the supplier invoices they will check against the list of prepared purchase orders.

Downsides: The booking person have to precalculate all the expected costs, for late changes you have to remember to change again. - Central registration, integration.